Some Known Factual Statements About Offshore Company Formation

International Companies can loan funds to firms in various other foreign nations. Financiers may establish up, however not straight very own, an offshore firm that finances funds to a growth business established up in another country and also cost rates of interest that will certainly decrease tax obligation commitments as well as shield the long term capability to repatriate investment funds.

Working across a variety of jurisdictions, we make every effort to provide our clients the best solution feasible when they are wanting to develop an overseas firm. We have actually created our firm unification solutions to mirror the abilities and abilities of our professional specialists. Offshore Firm Development deals numerous advantages; both economically as well as legally.

This helps ensure business management satisfies neighborhood guidelines following initial facility. An additional element of being able to effectively safeguard your assets and also handle your riches is of course picking the appropriate bank account.

Establishing an overseas firm can feel like a complicated possibility and that's where we come in. We'll guide you through the stages of firm development. We're additionally satisfied to communicate with the necessary authorities as well as organisations on your behalf, to make sure the whole procedure is as smooth and also smooth as feasible.

Offshore Company Formation for Dummies

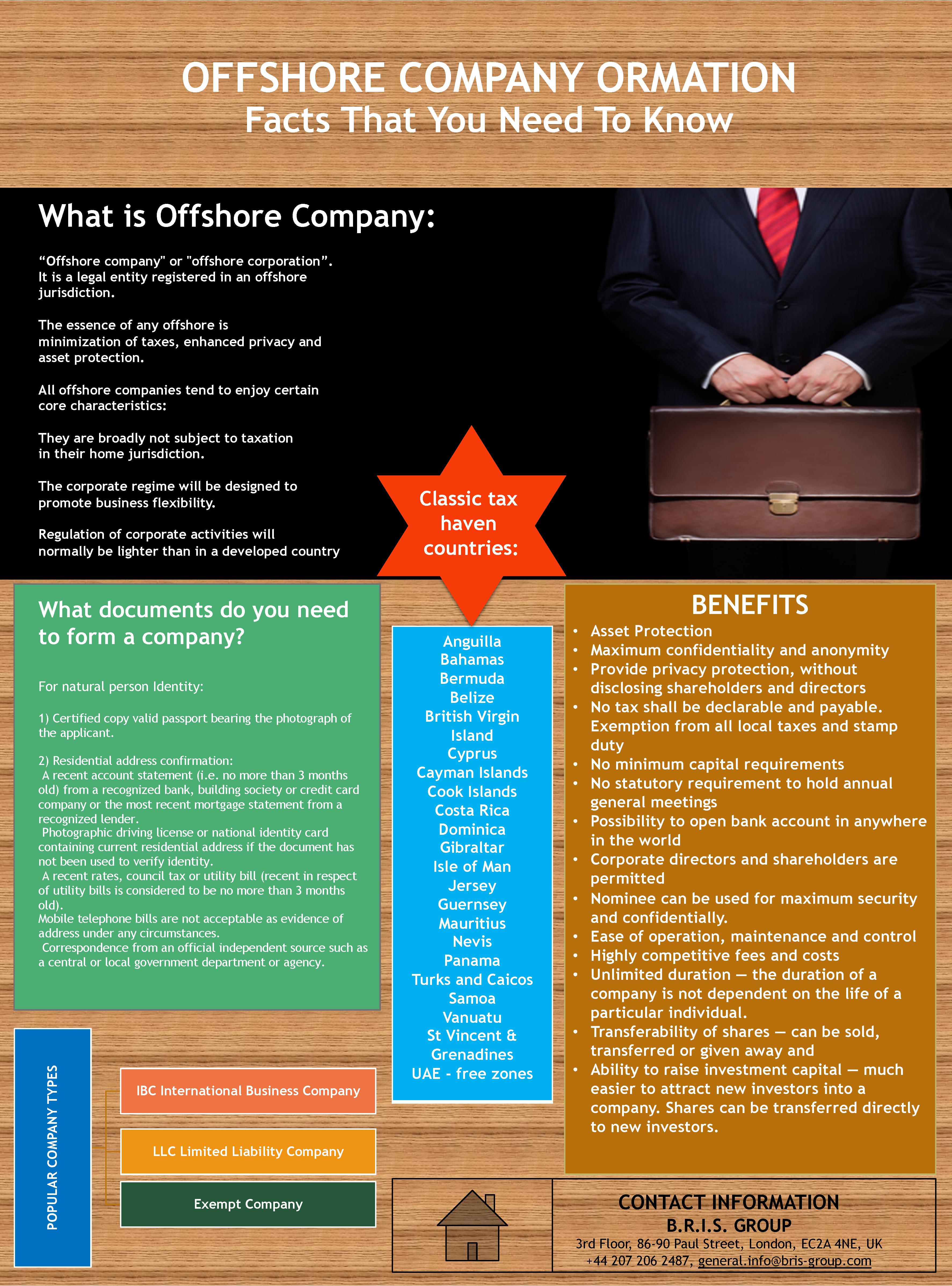

Many business-owners begin at this moment identifying the right jurisdiction for their business. This will certainly depend on a number of different variables, and we can use support as well as recommendations throughout. Please see our section listed below for further information. Choosing a name. Selecting a firm name isn't always as straightforward as you might assume.

This will cover a variety of info, such as: details of the shares you'll be releasing, the names of the business supervisor or supervisors, the names of the shareholders, the business secretary (if you're planning to have one), and also what solutions you'll require, such as online offices, financial etc. The last part of the procedure is making a payment as well as there are a variety of ways to do this.

When choosing the best territory, a number of variables need to be considered. These consist of existing political scenarios, certain conformity demands, plus the legislations and regulations of the nation or state. You'll additionally require to think about the following (among other points): The nature of your organization Where you live What properties you'll be holding Our group are on hand to assist with: Ensuring compliance when forming your business Understanding the neighborhood guidelines and legislations Financial Communicating with the needed organisations and also services Company management Annual renewal costs related to formation We'll assist with every facet of the company development procedure, despite the territory you're operating within.

Overseas business development has actually been made effective and simple with the GWS Team as we supply full assistance in regards to technical assessment, legal appointment, tax obligation advisory services that makes go to these guys the entire process of overseas firm formation smooth, without any hiccups or bottlenecks - offshore company formation. Today, a variety of offshore firms who are operating successfully globally have click for more actually gone on and availed our solutions as well as have gained abundant advantages in the due program of time.

Everything about Offshore Company Formation

An application is filed to the Registrar of Business with the asked for name. The duration for the authorization of the name is 4-7 business days. Once the name is authorized, the Memorandum as well as Articles of Organization of the firm are ready and submitted for registration to the Registrar of Companies together with the info regarding the policemans as well as investors of the business.

The minimal number of supervisors is one, who can be either a private or a lawful entity. Usually members of our company are selected as nominee supervisors in order to perform the board conferences as well as resolutions in Cyprus. In this method management as well as control is made in Cyprus for tax purposes.

Immigrants who do not want to look like registered investors might select candidates to represent them as registered investors, whilst the actual possession will always reside the non-resident advantageous proprietors of the shares (offshore company formation). Our company can supply candidate shareholders services upon request. The existence of the business assistant is needed by the Law.

Although the race of the assistant is unimportant it is suggested the secretary of the firm to be a resident in Cyprus. The Cyprus Business Legislation requires the existence of the authorized office of the firm on the region of Cyprus. The company keeping the IBC uses the services of a virtual workplace with telephone, fax as well as all various other pertinent facilities to assist in the management of the IBC.

Little Known Facts About Offshore Company Formation.

The advocate's office is generally declared as the signed up address of the firm, where fax, telephone and other centers are offered. With our company you can sign up a Belize company development, form an overseas Belize company and also set up Belize offshore checking account. Belize is an independent nation near Mexico without any capital gains tax obligation or inheritance tax obligation.

Development of a Belize IBC (global service companies) suggests no tax obligation would be paid on any income produced by the Belize business visit this site from abroad task. Belize also has a special tax guideline for individuals that are resident yet not domiciled there: you just pay tax obligation on income derived in Belize.